How DeFi debit cards will transform payments and disrupt traditional finance?

DeFi debit cards represent the next evolution in payments by connecting decentralized blockchain networks powering digital assets to real-world spending at checkout counters and online merchant gateways globally. This card resembles a regular Visa or Mastercard-backed card that is used to spend currency anywhere the payment networks operate. However, instead of topping up the card via bank accounts or wires, balances are funded by purchasing and transferring cryptocurrency into a linked mobile wallet app.

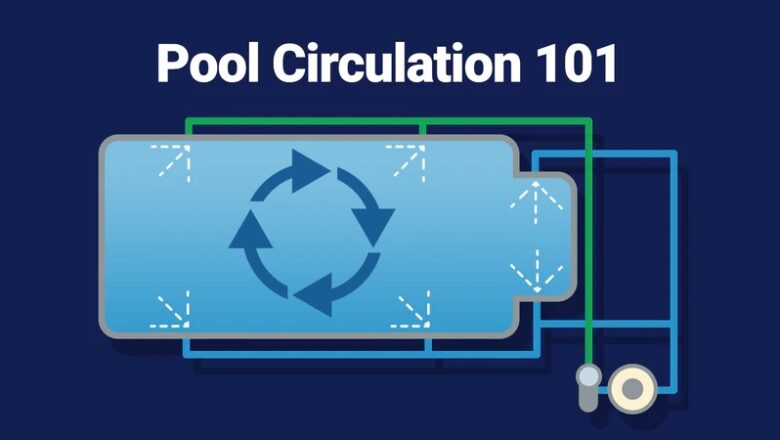

When transacting, designated crypto assets get automatically converted into fiat currency in real-time based on live rates, followed by settlement with the merchant through traditional debit card payment rails. The process leverages an ecosystem of smart contracts, custodial reserves, ...